About Us

Plan B Debt Relief was founded over 10 years ago as a true advocate for people struggling with debt.

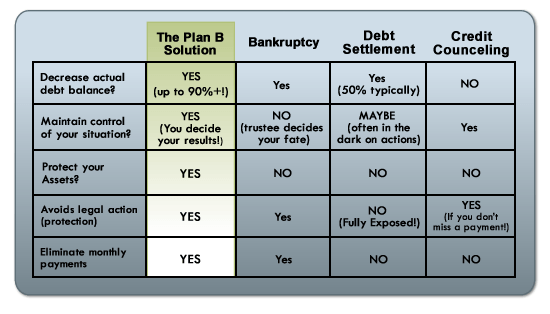

Our mission is to continually provide the best alternative to bankruptcy while offering the fastest way out of debt, the least costly option to get out of debt, and the most protection to our clients and their assets so they can have true peace of mind and continue on with their lives without the burden of unsecured debt.

Facing debt can be very overwhelming and feel like a hopeless situation, but all of us here at Plan B want you to know that we are here to help.

FREE Debt Elimination Calculator

instantly see how much money you'll save

(no opt-in required)

About Our Debt Relief Program and Legally Avoiding Payment

The objective of our program is to protect our clients so that no creditor gets anything from them, EVER.

Debt Elimination includes the strategies and methods of legally avoiding payment of account balances claimed to be owed to creditors and/or debt collectors.

Our system frequently results in reducing unsecured debt down to under 10% of what was owed within the first year and even the full balance being cancelled completely within 18 months. All while protecting our clients’ income, bank accounts and assets from garnishment or seizure and preventing harassing phone calls. There simply is not another solution like it. Our goal is to help you to maintain as much control of your situation as possible.

Did Good Credit Leave You Lots of Debt?

The one thing that good credit can certainly assist you in doing, as it does for many consumers, is get you into unbearable and perpetual debt. For most people, the only way to pay down these accounts is if they had a windfall income, like winning the lottery. This is humorous for many people to hear, but once reality is understood, it should be frightening.